Flags of the World

In: Interactive Maps Reference

2 Feb 2011Roll over any nation on this map of the world to see that country’s flag, as well as an explanation of the symbolism of its design. For example, the colors in Egypt’s flag represent oppression (black), overcome through bloody struggle (red), to be replaced by a bright future (white) – a timeless design, apparently. Thanks to Jack Lucky for the link!

Wall Street Compensation: 2010

2 Feb 2011In 2010, total compensation and benefits at publicly traded Wall Street banks and securities firms hit a record of $135 billion […] The total is up 5.7% from $128 billion in combined compensation and benefits by the same companies in 2009.

The interactive tree-map has a nice introduction of how it works, but it would have been nice to be able to drill down further to firm level data. On the two bottom graphs, they could have combined them using the same scale so it was easier to view the revenue/profit/compensation ratios. (related article)

If Earth Was the Center of the Solar System

In: Science

2 Feb 2011Ok, this is one of the coolest toys I’ve played with in a while (or maybe I’m just a science geek). Piotr Kaczmarek has modeled the solar system using both Copernican (sun-centered) and Tychonian (earth-centered) physics. You can set the particular date you want to view, the speed that time goes by, view the zodiac, and even the phases of the moon. If you turn on the planet tracing in the Tychonian model you can see what odd orbits it requires. (via)

The FT created an interactive bar chart of the IMF’s COFER data on foreign currency holdings. Watching the growth since 2006 is particularly stunning. Design wise, the dynamic resorting of the countries is an interesting variation.

Posted at the same time was a map of China’s imports with details clickable by country. This is all part of the FT’s in depth “China Shapes the World” feature.

Note: some Financial Times features require a subscription.

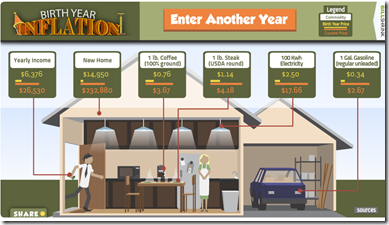

Birth Year Inflation

In: US Economy

31 Jan 2011Type in the year you were born and see how the average incomes and the prices of houses, coffee, steak, electricity, and gasoline have changed. These kinds of broad comparisons are always statistically weak (a house how big? what job? etc) but it’s still kind of entertaining. (via The Big Picture)

Global Inflation

31 Jan 2011An interactive heatmap of inflation across the globe, from the WSJ. Well done, but I would have expected some 2010 data in there by now.

Fun and Games with Airline Ticket Prices

In: Interactive Maps Reference

27 Jan 2011The Wall Street Journal has a nice article about the weekly ebbs and flows of airline ticket sales. If you want to dig deeper, farecompare.com has done some longer period analysis of this topic.

Flipping the typical fare question on it’s head, below is a very cool interactive map where you input how much you want to spend and it will show you where you can fly for that much money:

Kayak.com has also graphed a few charts of average ticket prices, and provides downloadable data:

Finally, since we’re on the topic, I want to give a Chart Porn graphic design gold star to Hipmunk’s flight reservation site. It’s what selecting a flight should look like:

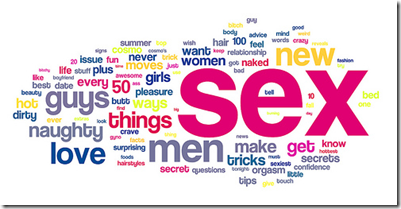

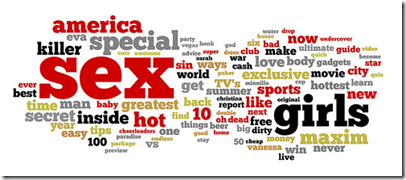

Crappy Sexist Magazines: Maxim vs Cosmo

In: Culture

25 Jan 2011Darren Barefoot compared the words that appeared on the covers of three years of Maxim magazine to three years of Cosmopolitan. Can you tell which of the below are which?

His post identifies several interesting observations, as do the related comments over at Sociological Images.

For comparison, here is a cloud from Cosmopolitan in the 1970s:

From National Geographic, a wordle type cloud map based on the distribution of common last names.

We Pick Stocks Like We Pick Cute Animals

In: Culture Stock Market

24 Jan 2011Building on my criticism in yesterday’s post, half of the people in this NPR experiment were asked to view three animals and pick the cutest; the other half were asked to pick which one they thought everyone else would think is the cutest. The results are below. The authors point out that this isn’t a new analogy, with Keynes having observed in 1936 that the stock market runs like a beauty contest. It’s an interesting example of how individual preferences can differ so much from social choices.

In the market, Keynes argued, it doesn’t make sense to invest in the company you think is best. It makes sense to invest in the company that you think other people will think is best. Because if everyone else invests in a company, the price of its stock will rise.

Of course, when everyone does this, it leads to a slippery investment world. “We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be,” Keynes wrote.

Pietra Rivoli, a professor at Georgetown’s business school, explains the problem with a market like this: “The key danger is that nobody’s really thinking.”

US Energy Production and Consumption

23 Jan 2011I have no idea why this wasn’t done as a proper sankey diagram. It might as well just be a table.

Profane Twitter

In: Culture Internet/tech Maps

23 Jan 2011Daniel Huffman filtered 1.5 million tweets from March and April 2010 and mapped the rate of profanity across America. (via; note: the link below is to a 12mb pdf file)

From Bull to Bear and Back Again

In: Stock Market

22 Jan 2011This graphic illustrates a stock’s rise and fall, created by stock analysis tool site Alphascanner. Part of me hates the effect these quant/tech trend analyses have on the financial markets (as oppose to going by, say, what the company actually does) – but such is the world we’ve created. (via)

The US Economy in Two Visualizations

In: Employment Finance Housing Interactive Maps Updated regularly US Economy

22 Jan 2011If you want to know the state of the US economy at any time, check out the below visualizations from Russell Investments and the AP. They are both updated monthly with the latest data, allow all kinds of drilling down, and both take the time to document sources and explain why you should give a shit about these particular numbers (for example, click on any of the “historical details” links on Russell’s dashboard).

What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]