US Economy Archive:

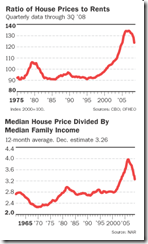

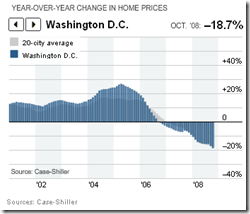

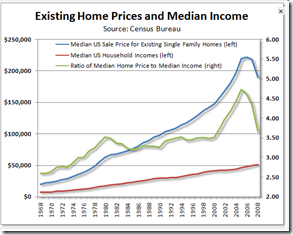

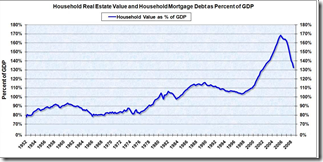

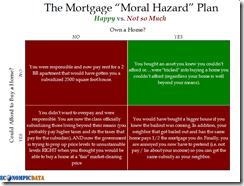

Housing prices still too high

23 Feb 2009Related Big Picture post.

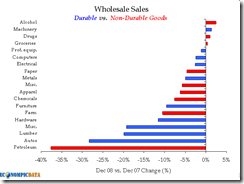

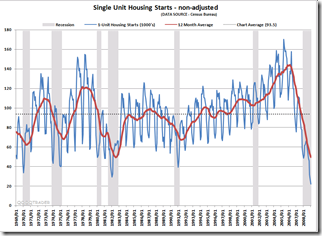

Some Housing charts

19 Feb 2009From The Big Picture.

Stimulus Package Breakdown (updated 2/12/09)

13 Feb 200910-year Return on Investments

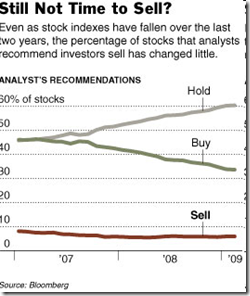

9 Feb 2009Do Analysts Ever Get it Right?

9 Feb 2009What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

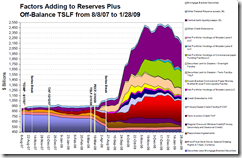

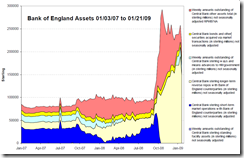

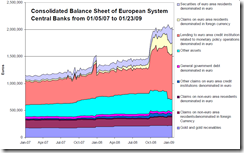

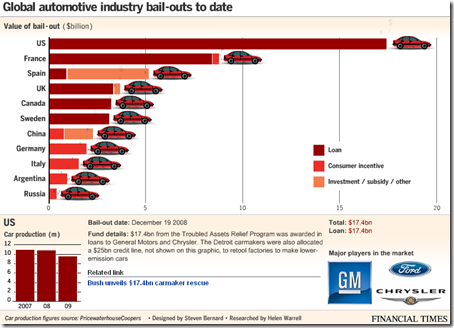

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

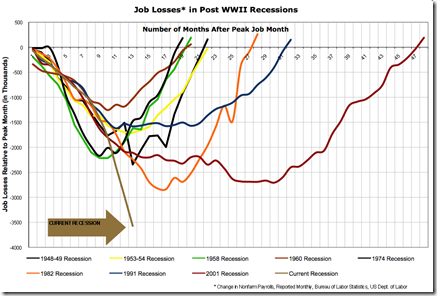

- Employment (245)

- Environment/weather (133)

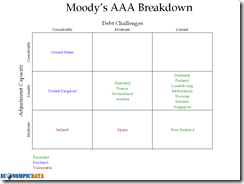

- Finance (298)

- Food (92)

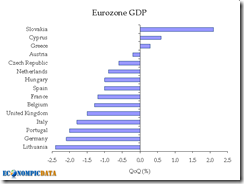

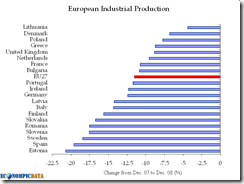

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

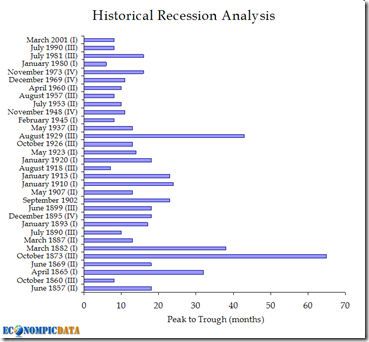

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

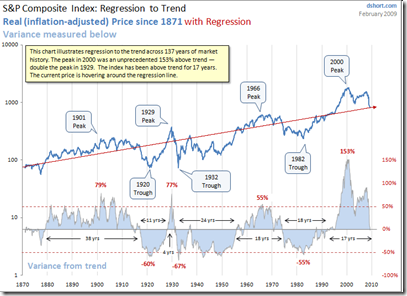

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]

Mea Culpa from Goldman Sachs

In: Commentary Finance Source: FT Stock Market US Economy

9 Feb 2009No charts. Just a decent letter from CEO Lloyd Blankfein to the FT on mistakes and lessons. Excerpts: