US Economy Archive:

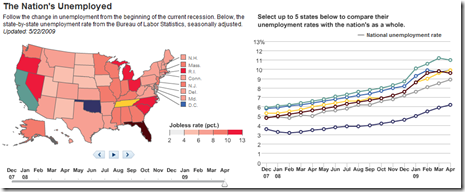

US Unemployment Map

27 May 2009Data from Dec 07- Apr 09. There isn’t too much interesting here, unless you want to compare states using the chart on the right.

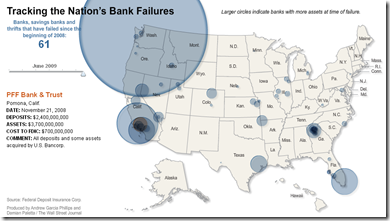

Map of Bank Failures Jan-08 to June 09

26 May 2009The interesting part are the bubble roll-overs: they show who tookover each bank’s assets, and how much each closure cost the FDIC.

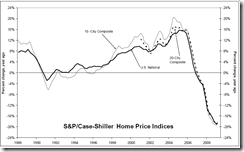

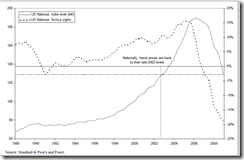

Home Prices Continue Down (Mar 09)

26 May 2009Charts from Ritholtz below. An amusing article on how they’re trying to spin them as not that bad: “Case-Shiller Sucks. But Who Cares, That’s Just Backwards Looking” by Joe Weisenthal.

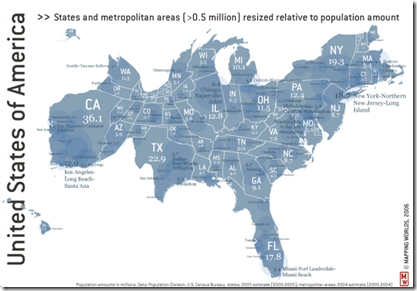

US Population Proportionate Map

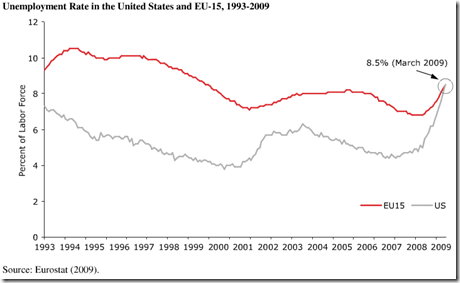

26 May 2009US/EU Unemployment Rates Converging

In: Employment US Economy

21 May 2009“From the early 1990s through the peak of the last business cycle, relatively low U.S. unemployment rates seemed to make the United States a model for the rest of the world’s economies. The Organization for Economic Cooperation and Development (OECD), the International Monetary Fund (IMF), and other international organizations all praised the U.S. unemployment performance and urged the rest of the world’s rich countries to emulate the “flexibility” of the U.S. model. However, this report shows that in the current economic crisis, the U.S. unemployment rate ranks 4th to last among the major OECD countries.” Source: CEPR

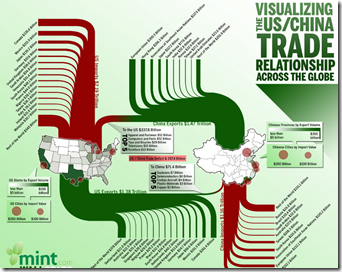

US China Trade

19 May 2009These info graphics are always pretty, but I sometimes wonder if a table isn’t just as good, or better. Perhaps if they added capital flows.

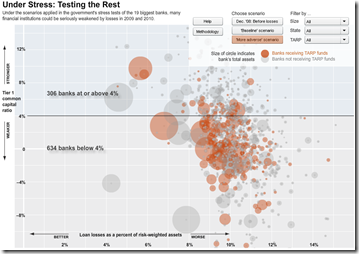

Stressing the Rest

19 May 2009The WSJ stress-tested 900+ smaller banks. Sort by stress scenario, size, state, and tarp-recipients. Related article.

Nickel and Diming Airlines

In: US Economy

17 May 2009In case you are having trouble keeping all the bullshit straight.

a more comprehensive (and likely regularly updated) version is at Kayak.

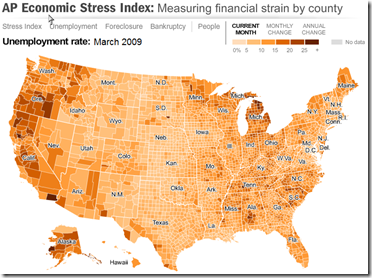

US Economic Stress Index (March 09 data)

17 May 2009More good work from AP. Shows unemployment, foreclosures, bankruptcy, and a composite “stress index”. Double click on a region to zoom in; click&hold to move around.

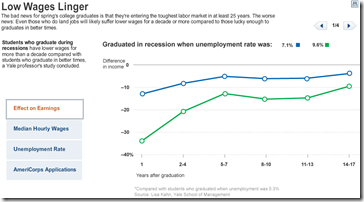

Bad Time to Graduate

15 May 2009“The bad news for spring’s college graduates is that they’re entering the toughest labor market in at least 25 years. The worse news: Even those who do land jobs will likely suffer lower wages for a decade or more.” Related article. Tab through related stats in the below graphic:

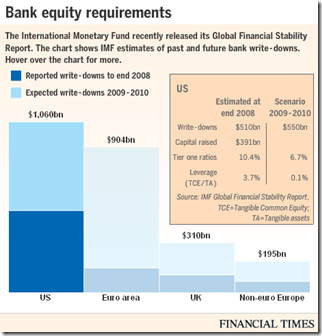

Writedown Estimates (again)

In: Bailout Finance Global Economy Interactive Source: FT US Economy

14 May 2009As we noted a couple weeks ago, the IMF released estimates of bank writedowns past and future in this years GFSR. Below is today’s FT interactive graphic of the same info (the total is $4 trillion if you were wondering).

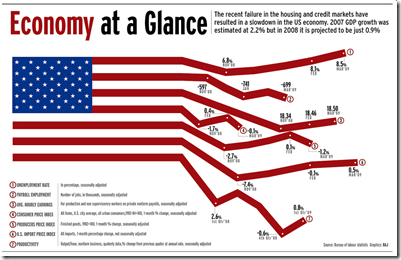

Economic Flag

In: Innovative US Economy

14 May 2009The title is a little odd considering they include March 09 data, but it’s still a clever presentation. Hmmm. actually now that I look at it the lines aren’t moving proportionally, which means this is mostly gimmickry. Too bad.

(more) OECD Composite Leading Indicators

12 May 2009I just noticed that the front page FT graphics I posted earlier today were actually just chopped versions of figures from the OECD’s press release. You also might notice that this analysis covers six non-OECD countries (Brazil, China, India, Indonesia, Russian Federation and South Africa). Here’s the Raw data if you want to dig.

OECD Business Cycle Clock

12 May 2009The OECD has a nifty toy, the Business Cycle Clock, where you can construct animations of business cycles for different countries. The example below shows USA Industrial Production, Business Confidence, Consumer Confidence, and a Composite Leading Indicator – the arrow heads show March 09 and the tails the previous periods. The four quadrants show downturn/slowdown/expansion/recovery. You can even throw up two different countries to compare performance. I wish there was a way to export the animations.

OECD Composite Leading Indicators

12 May 2009“OECD composite leading indicators (CLIs) for March 2009 continue to point to a strong slowdown in the OECD. However France, Italy and the United Kingdom are showing tentative signs of, at least, a pause in the economic slowdown. Weak though these signals are, they are present in the majority of the CLI component series for these countries. In other major OECD economies the CLIs continue to point to deterioration in the business cycle, but at a decreasing rate. However, with the exception of China, where signs of a pause have also emerged, major non-OECD economies still face deteriorating conditions.”

Related FT article.

OECD press release and data website (will be updated regularly)

What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]