US Economy Archive:

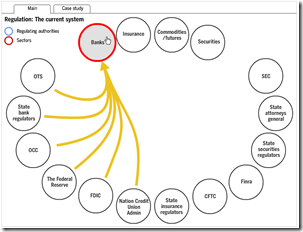

Overlapping Banking Supervision

14 Jun 2009Interactive chart from FT. Related article.

US Health Care

14 Jun 2009A series of 10 charts and infographics on the history and proposals for health care reform, from the Washington Post, (includes an audio narrative).

NAFTA Comparison

14 Jun 2009Component comparisons of North America’s economies, environment, people, and military, from Mint.

USAToday Economic Outlook Index

In: Finance Housing Interactive Reference Source: USA Today Updated regularly US Economy

11 Jun 2009USA Today and IHS Global Insight have created a new USA economic outlook index based on 11 “leading” indicators. The interactive charts are very well done, with roll-over data point info, and an explanation of what each indicator means. Notes at the bottom of the page describe how the methodology differs from the Conference Board’s “leading indicators”. They plan to update it monthly. USAtoday has come a long way from the crappy charts they used to produce (ok, a lot of them are still crappy – but this one’s damn good).

(note: I spotted this one because Utah has crappy newspapers and my only option for any actual news of the world was USAToday)

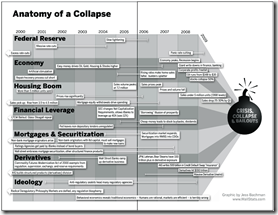

Anatomy of the Crash

In: Bailout Finance Innovative Reference Source: Ritholtz US Economy

10 Jun 2009(Sorry there haven’t been many updates lately – I’m on vacation in the Colorado mountains.) Here is a infographic from Barry Ritholtz’s book Bailout Nation that does a great job showing the different causes of the crash, and how they developed over time:

The Global GM Picture

In: Bailout Maps US Economy

2 Jun 2009US Auto Market Share 1980-2008

31 May 2009roll-overs show the ten-year data trends. What surprised me was how GM has taken the bulk of the loss, with Chrysler actually holding pretty steady.

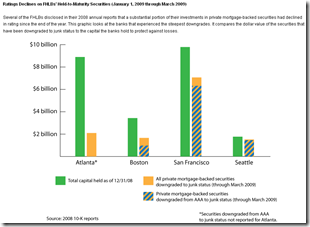

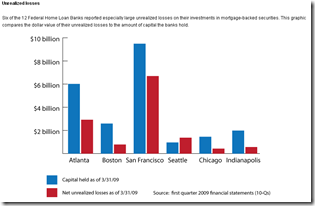

Federal Home Loan Bank Investments

In: Finance Housing US Economy

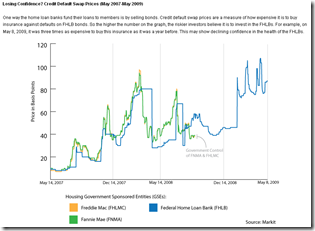

29 May 2009Worrisome analysis from SubsidyScope:

“The Federal Home Loan Banks, or FHLBs, may be the biggest financial players you’ve never heard of. Collectively, they hold $1.3 trillion in assets and are the largest U.S. borrower after the federal government.

A Subsidyscope review of the FHLBs’ financial statements has found that several of the banks are carrying substantial “unrealized losses” on their investments in mortgage-backed securities. [.]

What’s potentially worrisome is the sheer size of the losses. For the Federal Home Loan Bank of Seattle, they are substantially larger than the capital the bank holds to protect itself against such declines.”

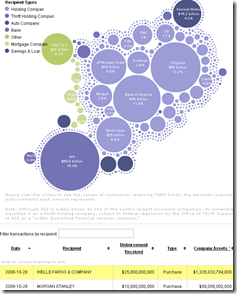

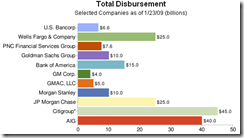

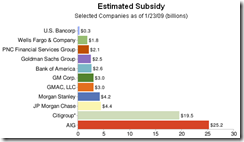

SubsidyScope Bailout Visualizations

29 May 2009Created by the Pew Charitable Trusts, SubsidyScope.com has some interesting visualizations, and looks to be a great resource for tracking these issues going forward. The blog on the front page is great as well.

Tarp disbursements by recipient or date, and the transaction table at the bottom keeps up with your mouse clicks:

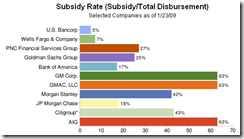

Estimates of the subsidy rates (also a good read on how TARP works):

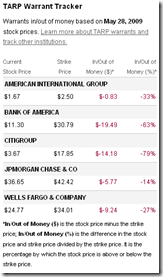

Value of TARP government warrants:

Visual Guide to the Federal Reserve

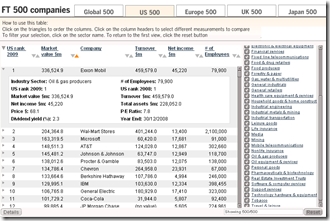

29 May 2009The FT 500

In: Finance Global Economy Interactive Source: FT Stock Market US Economy

29 May 2009Interactive table of top 500 companies in the world (and for US/EU/UK/Japan) by market cap. You can sort any column, filter by sector, and drill down each company to see stats and historical rankings.

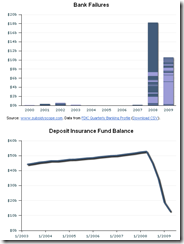

The Problems Haven’t Gone Away

29 May 2009Well, the banks are close to being recapitalized, so that brings us roughly back to where we started (minus 5 million jobs and $11 trillion in wealth). But while that is a necessary condition for recovery, many of the other original problems (excessive household debt, for example) just keep chugging along.

“About 5.4 million of the country’s 45 million home loans were delinquent or in some stage of the foreclosure process in the first three months of the year, according to the Mortgage Bankers Association. [.] The figures released Thursday suggested that prime fixed-rate loans were supplanting risky subprime loans and rising adjustable-rate mortgages as the force behind the foreclosure crisis. In the first quarter, a seasonally adjusted 6.06 percent of all prime loans were delinquent.” (WSJ)

Rich or Poor?

27 May 2009I think a lot of us take for granted how good we have it. Here’s a nice look at how “rich” you are, by Catherine Mulbrandon at visualizingeconomics.com. It’s been around for a while (uses 2000 data), but I just found her website this week.

Credit Crisis Indicators

In: Global Economy Reference Source: NYT Updated regularly US Economy

27 May 2009The NYT maintains a tool showing the latest updates for five credit market indicators (3mo Treasuries, Libor, Ted spread, 30-day commercial paper, and high yield bond yields). Sometimes I just want a quick look at the latest numbers.

Note: Similarly, their Markets page and Economy pages provide clean up-to-date presentations on a variety of indicators.

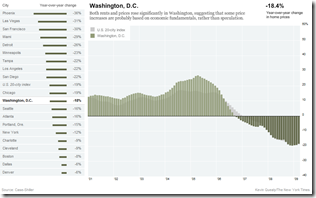

Case-Shiller (mar 09 data)

27 May 2009The NYT has updated one of my favorite interactive presentations of Case-Shiller’s 20 city housing index. It shows how each cities’ performance versus the national index (the light grey bars in the background).

What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]