US Economy Archive:

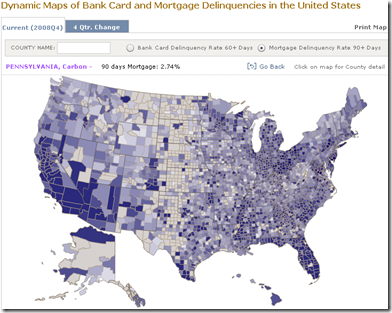

Credit Card and Mortgage Delinquency Map

29 Jun 2009From the NY Fed. Data available by county.

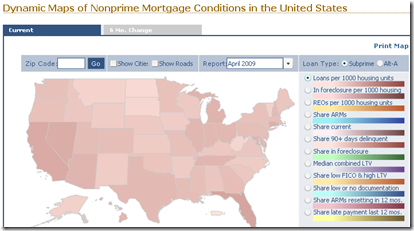

Non-Prime Mortgage Map

29 Jun 2009Produced by the NY Fed, this is an interactive map of non-prime mortgages. You can zoom down by zip code, view either the current or 6 month change, and pick from an assortment of loan-type indicators.

Housing is in Poor Shape

28 Jun 2009Despite what the NARs talking heads spout to the MSM at every data release, housing has not turned a corner. The related article includes a good explanation of what the charts show. For discussion check out Ritholtz’s post on the same article.

Credit Card Hell

28 Jun 2009Anyone else think the recent “reforms” didn’t address the problem of many people’s credit cards, namely the usurious interest rates? Spotted over at Ritzholtz.

Where Are We From?

28 Jun 2009I missed this back in march but just spotted a reference at Infographics. The NYT took 120 years of immigration data and threw it perfectly at a map – you can filter by country of origin, then move through time with the slider.

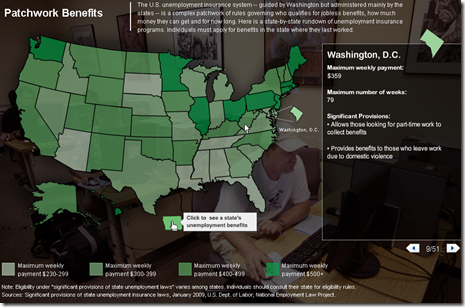

Best State to Be Unemployed?

26 Jun 2009Map of each States’ unemployment benefits. Related article.

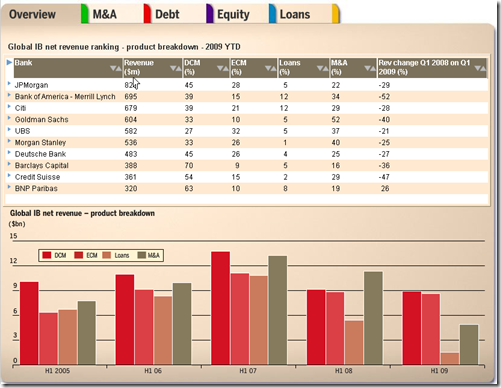

Investment Banking (1st Half 2009 update)

26 Jun 2009The FT has updated its interactive tables of investment banking activity. Lots of good data in here.

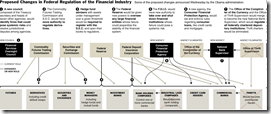

Financial Reform

In: Finance Global Economy Source: FT Source: NYT Source: Ritholtz Stock Market US Economy

23 Jun 2009Summary of EU and US reforms. The related article is a very good read on the subject.

NYT’s version of just the USA (hat-tip to Ritholtz). Related article.

Yet Another Recovery Index

In: Bailout Employment Finance Housing Updated regularly US Economy

22 Jun 2009This one from Kiplinger. Pretty standard stuff – a color-coded summary and charts for each of six components. Uses a pretty weak (but easy to understand) recovery threshold: “When at least three of the six indicators go fully positive — with a check mark from us — it’s more than likely that the recession has ended.” The "watch for" section of each indicator are interesting.

Weird Green Shoots

22 Jun 2009Not really a graphic (though there is a slideshow version), Kiplinger lists 10 Quirky Economic Indicators, from movie attendance to alligators and mosquitoes.

States Facing Budget Crisis

22 Jun 2009The article is more interesting than the graphic.

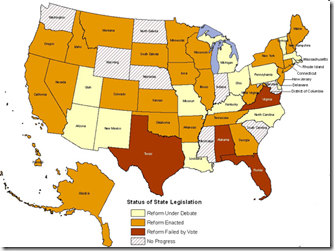

Unemployment Reform

22 Jun 2009Many states are modifying their unemployment benefit laws, some in connection to the recession and some to take advantage of federal stimulus money. Related NYT blog post.

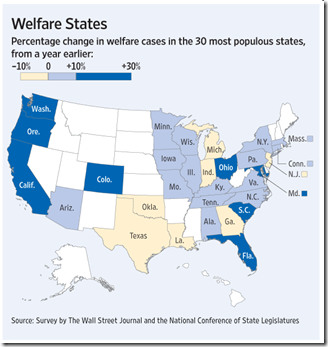

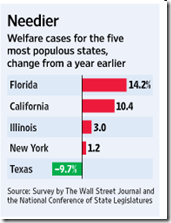

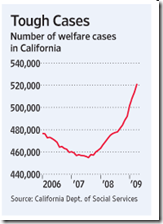

Welfare Rolls Swelling

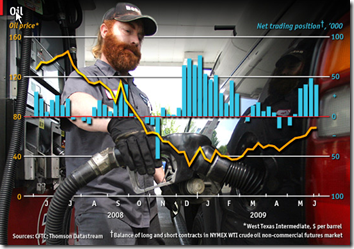

22 Jun 2009Oil Speculation

19 Jun 2009THE oil market is behaving like a bucking bronco again, and politicians are once more blaming speculators for careening prices. It is difficult to assemble a definitive explanation for the rally: a weak dollar helps oil prices, but evidence for improving supply and demand remains thin. Positions held on NYMEX, the New York commodities exchange, have indeed soared.

What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]