US Economy Archive:

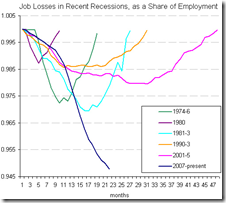

This Time is Different

2 Oct 2009NYT Economic Indicators

In: Employment Finance Housing Reference Source: NYT US Economy

2 Oct 2009The NYT has a nice tiny tool that provides the most recent data for 25 economic indicators (housing, employment, production, confidence, etc). It appears at the top of their “Economy” page, and an ugly version of the flash tool can be viewed directly here.

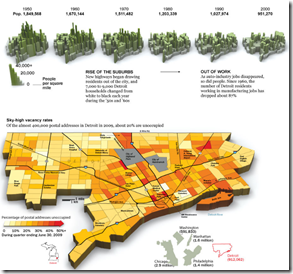

Death of Detroit

In: Culture Maps US Economy

25 Sep 2009Half the population has left (since 1950). Unemployment is at 29%. Average price of a house: $15 thousand. Related article. Beautiful horrible photos.

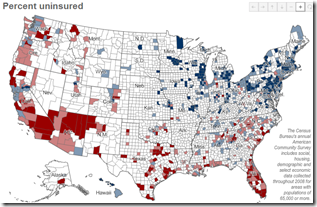

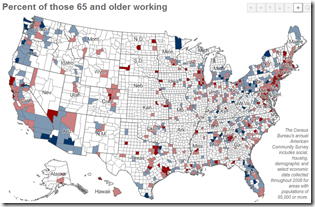

State of the Union

In: Culture Housing Maps US Economy

25 Sep 2009A number of interesting maps: percent of people uninsured (below), percent of people 65+ years old still working (below), median income, homeowners, percent of carpoolers, commute time.

Fun With [Banking] Data

In: Employment Finance Graphic Design (general) Reference US Economy

22 Sep 2009The St. Louis Federal Reserve has an excellent graphing tool called Fred Graph. You can view a variety of economic (not just banking) data over any time period, add/delete series at will, and download the raw data. Below is an example of commercial, consumer, and real estate loans (1940-today); and the same data zoomed in on 2007-today (note the total absence of increased lending). To start, pick a data series from the Fred Page then click on the graph itself to bring up more design options.

Bailout Update

22 Sep 2009Bailout Matrices

21 Sep 2009I question the value of “Bold/Weak” as an axis. but it’s still interesting to look at. Related CNNMoney article.

More interesting: Change in stock price one year later, versus level of federal assistance:

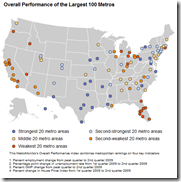

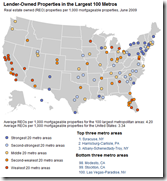

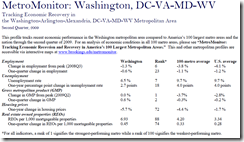

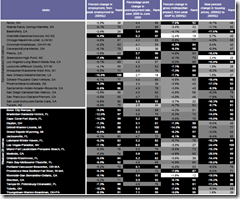

Brookings Metro Monitor (Sept 09 report)

21 Sep 2009Brookings is tracking the economic health of 100 USA metro areas using a variety of indicators. Below are the maps for overall performance and REOs (there are more on the site). You can look up summary reports for individual cities. Also interesting are the rankings, which appear in the appendix of the full report.

Related article. Once again, spotted over at Infectious Greed (I really should go there more often).

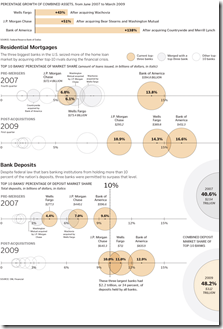

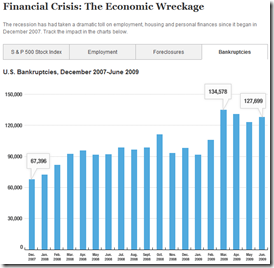

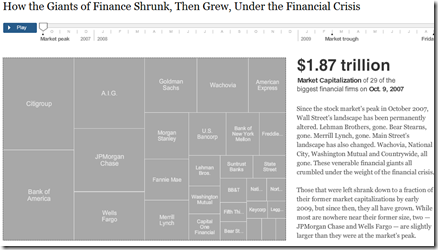

One Crisis Later

18 Sep 2009So many data releases focus (correctly) on percentage changes m-to-m or y-to-y; but once in a while it’s useful to look at the actual numbers. Below is the S&P, Employment, Foreclosures, and Bankruptcies.

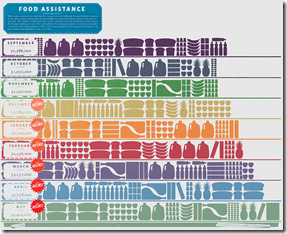

Food Stamps

In: Culture Food US Economy

16 Sep 2009At first I liked this, thinking that the icons identified different food assistance programs – but it’s just a one series bar chart (number of food stamp recipients). Spotted at FlowingData.

Lehman Diaspora

16 Sep 2009Move the timeline slider and watch former Lehman employees scatter to their new jobs. Click on blocks to see individual stories.

Crisis Timeline

16 Sep 2009Call up monthly slivers of data and related news for 6 financial market indicators (dow, treasury yields, libor, commercial yields, CDS spreads, mortgage backed spreads).

Economic Recovery Dashboard (9/15/09 update)

In: Employment Finance Innovative Interactive Reference Updated regularly US Economy

15 Sep 2009Here is this month’s update of one of my favorite presentations of economic indicators, from Russell Investments. Includes trending, useful popups, drill down links to historical data, and good descriptions of each indicator. It’s really everything an economic dashboard should look like. (ok, maybe they could animate it over time.)

Winners and Losers

13 Sep 2009What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]