Stock Market Archive:

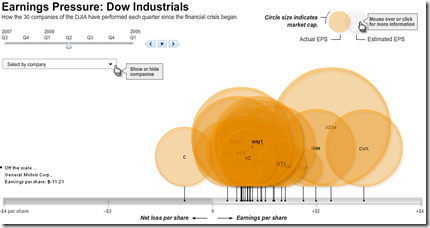

Dow Jones Quarterly Earnings

17 Apr 2009Global Equity Performance Map

In: Emerging Markets Finance Global Economy Interactive Maps Source: FT Stock Market Updated regularly US Economy

14 Apr 2009Interactive map displays the performance of all the major global equity markets for today, or versus a selection of time periods (5days/10days/1month/etc up to a year). You can also click on any exchange to drill down to more information.

[Note: There is no direct link to the map (silly java), you have to click on the "Market Macromap" window on this page]

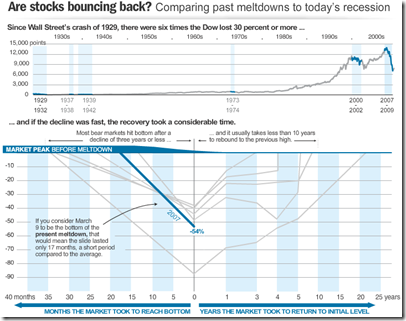

Recession Comparison

8 Apr 2009Interactive toy that bases recessions around the “bottoms”, from nicolasrapp.

Market Tree Map

In: Finance Interactive Maps Reference Stock Market Updated regularly US Economy

2 Apr 2009A tree map of more than 500 stocks, updated every 15 minutes. Click on the roll-over popups to bring up a pretty detailed drill down menu.

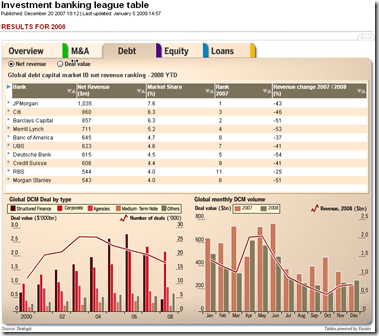

Stock Market Heat Map

In: Global Economy Interactive Maps Source: WSJ Stock Market US Economy

1 Apr 2009Interactive map of equity market performance (click on tabs to switch between quarters; click on dots for values)

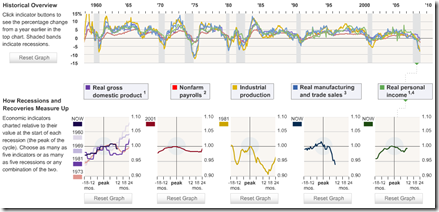

US Recession Comparison

In: Finance Interactive Source: WSJ Stock Market Updated regularly US Economy

2 Mar 2009This is a slightly complicated interactive way of viewing 5 different indicators across different recessions periods. It takes a minute to figure out how to work it, but it’s nifty once you do.

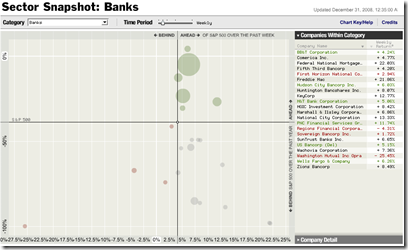

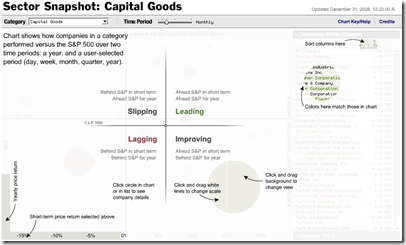

S&P Performance by Sector (updated daily)

In: Finance Interactive Reference Source: NYT Stock Market Updated regularly US Economy

25 Feb 2009Ok, someone obviously spent a lot of time designing this one, and it is very cool.

You select a sector (~30 are available) and the bubble chart shows how companies performed versus the short and long-term S&P 500. The bubble size shows market cap. You can easily change change the timeframe of the comparison (day, week, month, quarter, year) and scales, and drill down through company data.

example:

explanation:

10-year Return on Investments

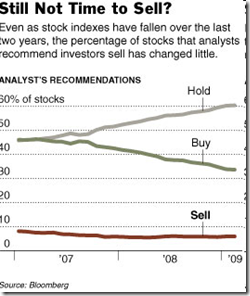

9 Feb 2009Do Analysts Ever Get it Right?

9 Feb 2009What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

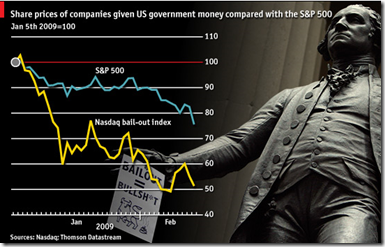

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]

Mea Culpa from Goldman Sachs

In: Commentary Finance Source: FT Stock Market US Economy

9 Feb 2009No charts. Just a decent letter from CEO Lloyd Blankfein to the FT on mistakes and lessons. Excerpts: