Source: NYT Archive:

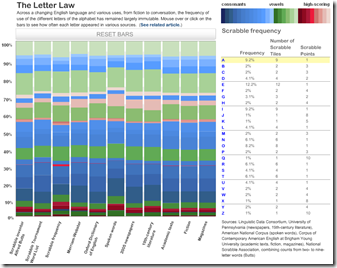

The Value of Letters

In: Reference Source: NYT

23 Mar 2009Not economics related, but an interesting interactive comparison of observations of a common data set over different sources. The related article is a good read.

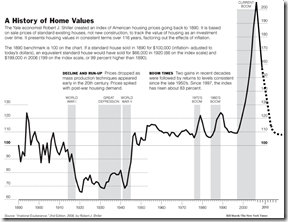

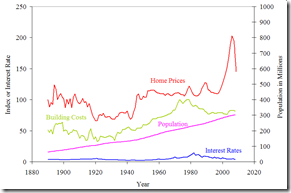

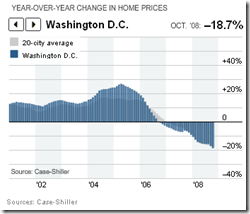

Nice Presentation of the Shiller Index

9 Mar 2009Most people are familiar with how this is calculated, but if you’re not:

While we’re at it, here’s the famous long term chart and explanation:

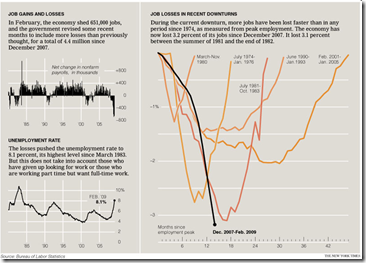

US Job losses (Feb data)

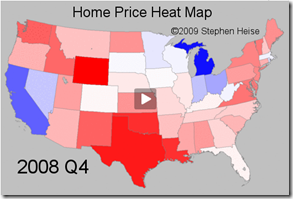

7 Mar 2009US Home Price Heat Map 1975-2008

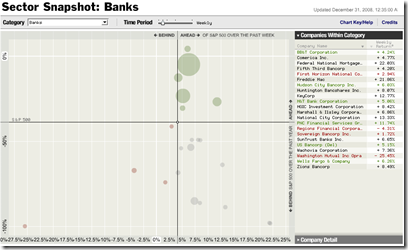

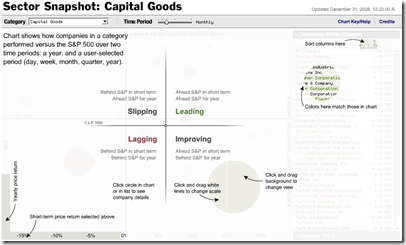

6 Mar 2009S&P Performance by Sector (updated daily)

In: Finance Interactive Reference Source: NYT Stock Market Updated regularly US Economy

25 Feb 2009Ok, someone obviously spent a lot of time designing this one, and it is very cool.

You select a sector (~30 are available) and the bubble chart shows how companies performed versus the short and long-term S&P 500. The bubble size shows market cap. You can easily change change the timeframe of the comparison (day, week, month, quarter, year) and scales, and drill down through company data.

example:

explanation:

10-year Return on Investments

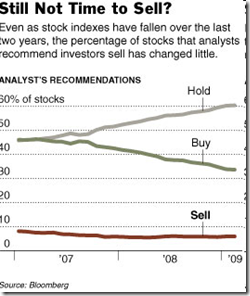

9 Feb 2009Do Analysts Ever Get it Right?

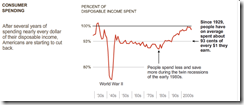

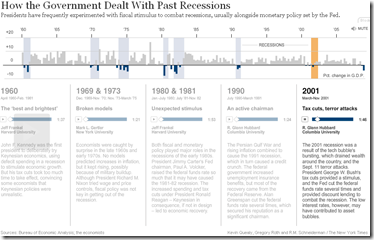

9 Feb 2009Past Recessions

22 Jan 2009Interactive narrated summary of previous US recessions, from NYT.

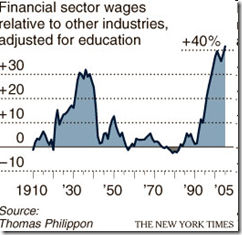

Wall Street Wages

22 Jan 2009US Unemployment vs other Recessions

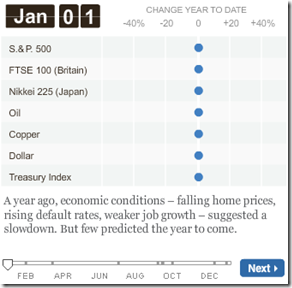

20 Jan 20092008 in Review

5 Jan 2009An animated calendar of major indicators, showing max and min as it goes (click on the “Next” button to run it through).

What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]