Source: FT Archive:

Top 20 Financial Institutions, 1999-2009

In: Finance Global Economy Interactive Source: FT US Economy

23 Mar 2009Click on a bank to highlight it, then move the year slider at the bottom to watch the rankings change

England and Wales House Price Map (Feb 09 data)

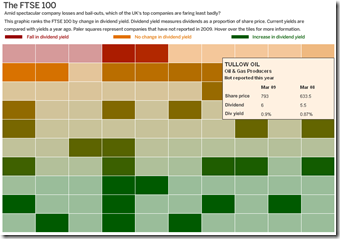

13 Mar 2009FTSE Dividends Heat Map

13 Mar 2009G20 Wishlist

In: Emerging Markets Finance Global Economy Interactive Source: FT

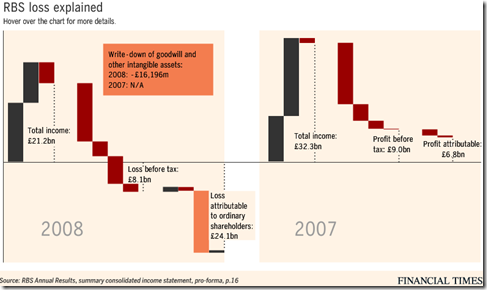

13 Mar 2009RBS Losses Explained

2 Mar 20092009 FDI Projections and IMF Loans

In: Emerging Markets Finance Global Economy Interactive Maps Source: FT

2 Mar 2009Net capital flows to emerging markets are set to drop to $165.3bn this year, down from $928.6bn in 2007, according to the Institute of International Finance. IMF loans are shown on the second tab.

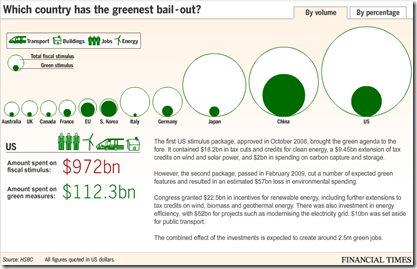

Stimulus Package Breakdown (updated 2/12/09)

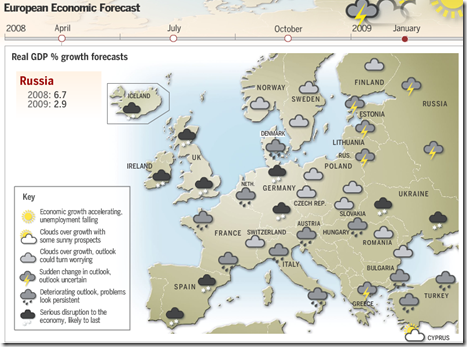

13 Feb 2009Asia Economic Weather Map

In: Emerging Markets Global Economy Interactive Maps Source: FT

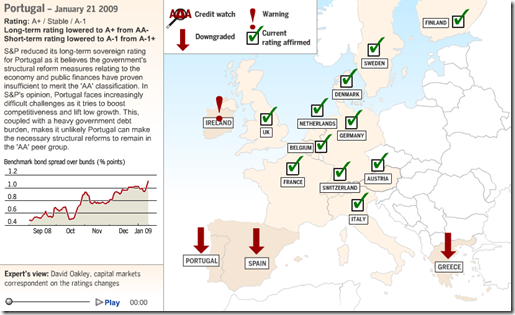

22 Jan 2009European Credit Ratings Map

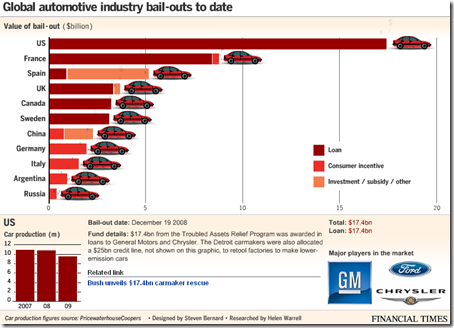

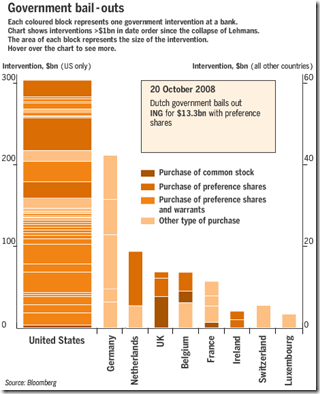

21 Jan 2009EU and US Bailouts

In: Bailout Finance Global Economy Interactive Source: FT US Economy

16 Jan 2009What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]

Mea Culpa from Goldman Sachs

In: Commentary Finance Source: FT Stock Market US Economy

9 Feb 2009No charts. Just a decent letter from CEO Lloyd Blankfein to the FT on mistakes and lessons. Excerpts: