Housing Archive:

How America Spends its Money

In: Culture Food Housing US Economy

24 Mar 2010From Bundle.com based on data from Citi.

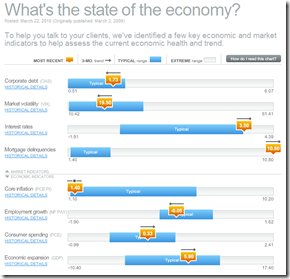

Economic Indicators Dashboard (Mar 2010 ver)

22 Mar 2010One of my favorite summaries of economic indicators. Click on any of the “historical details” to see what each indicator means and why it’s important.

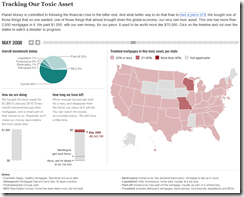

Tracking a Toxic Mortgage Security

19 Mar 2010A fantastic look at what owning one of these assets looks like. NPR’s Planet Money bought a $1000 mortgage bond and is tracking it’s performance. You can view how many payments they’ve received versus how many properties in their portion of the bond have been sold at a loss. Related article. (via Vizworld)

There’s also a cute simple explanation video:

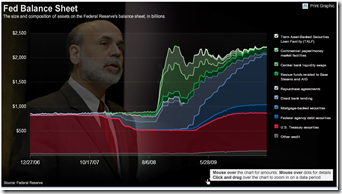

FED Balance Sheet (updated)

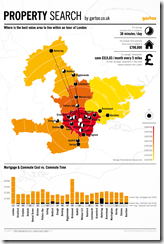

18 Mar 2010Best Commutes to London

15 Mar 2010Mortgages Still in Trouble

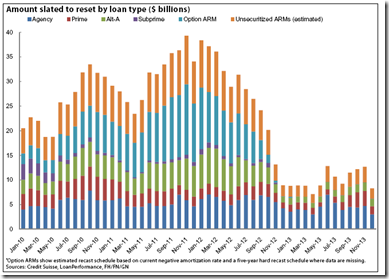

12 Mar 2010ARMS: $1 Trillion Still to Reset

9 Mar 2010Borrowers who already have seen their ARMs reset might be sitting on their hands and not refinancing into fixed-rate products, McBride said. Because mortgage rates have been so low recently, resets can actually lower, not raise, monthly payments. When that happens, borrowers might feel little urge to refinance into a fixed-rate product that would cost more per month. Alternatively, ARM borrowers might simply struggle to qualify for a refinance because of low or negative equity.

The problem, McBride said, is that when interest rates increase – which many analysts expect to happen over the next year – borrowers’ monthly payments might increase beyond what is affordable for them. And at that point, the fixed-rate products will no longer be attractive, or even financially viable, options.

(via)

Economic Indicators Dashboard (Feb 10 ver)

23 Feb 2010One of my favorite summaries of economic indicators. Click on any of the “historical details” to see what each indicator means and why it’s important.

USA Today Economic Outlook Index (Jan ‘10 version)

In: Employment Finance Housing Interactive Source: USA Today Stock Market US Economy

29 Jan 2010The best part is the lower chart showing the latest data for each of the 11 “leading indicators”. Updated 1/27/09.

Economic Recovery Dashboard (Jan 10 ver)

25 Jan 2010One of my favorite summaries of economic indicators. If you normally find this stuff confusing you should check it out – click on any of the “historical details” to see what each indicator means and why it’s important.

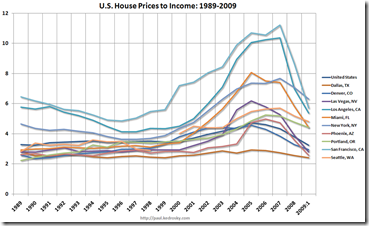

House Prices to Income

In: Housing US Economy

13 Jan 2010The following chart shows the ratio of U.S. housing prices to income for various major cities from 1989-2009. If we say bubbles exists in cities where that ratio is more than two standard deviations outside its long-run average, we still have residential real estate bubbles in Seattle, Portland, New York and Miami. On the other hand, bubble condition no longer exist in Dallas, Denver, Las Vegas, Los Angeles, Phoenix and San Francisco (!).

Global Housing Prices

5 Jan 2010What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]