Bailout Archive:

Stimulus Package Breakdown (updated 2/12/09)

13 Feb 2009FED Lending Instruments

22 Jan 2009A very nice table showing all of the FED’s Lending instruments and conditions:

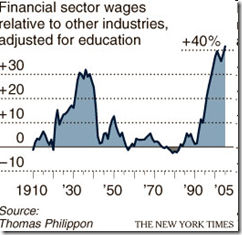

Wall Street Wages

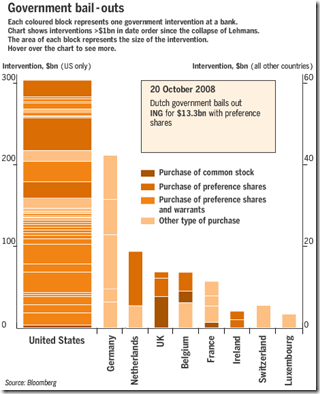

22 Jan 2009EU and US Bailouts

In: Bailout Finance Global Economy Interactive Source: FT US Economy

16 Jan 2009Animated Bailout Guide (another)

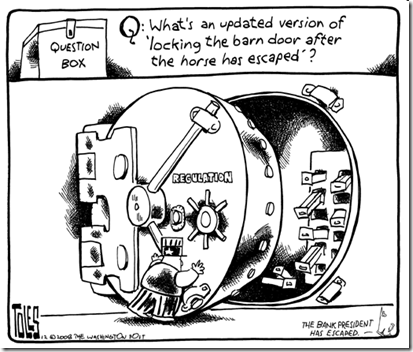

23 Dec 2008That Horse Has Left the Barn

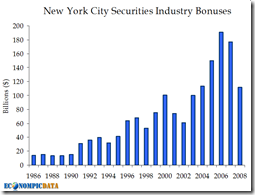

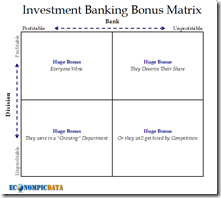

21 Dec 2008Wall Street Compensation

18 Dec 2008Related Article: http://www.nytimes.com/2008/12/18/business/18pay.html?_r=1

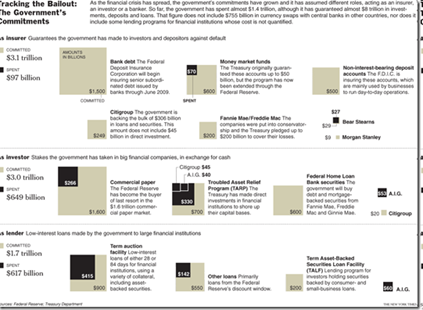

Show Me the Tarp Money

In: Bailout Finance Interactive Source: NYT Stock Market US Economy

16 Dec 2008A regularly updated summary of what institutions are getting aid:

or, The NYT version: http://projects.nytimes.com/creditcrisis/recipients/table

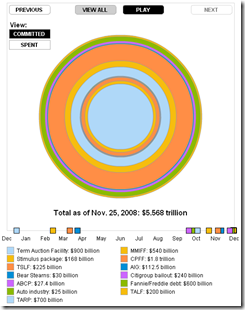

Bailout through November

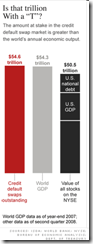

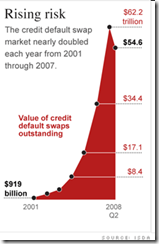

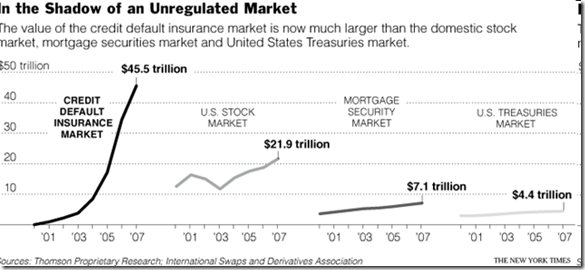

26 Nov 2008CDS Market Size

1 Sep 2008What is Chart Porn?

An addictive collection of beautiful charts, graphs, maps, and interactive data visualization toys -- on topics from around the world.

Categories

- Bailout (118)

- Chartporn Related (3)

- Commentary (21)

- Culture (669)

- Emerging Markets (66)

- Employment (245)

- Environment/weather (133)

- Finance (298)

- Food (92)

- Global Economy (373)

- Graphic Design (bad) (26)

- Graphic Design (general) (183)

- Graphic Tools (23)

- History (158)

- Housing (162)

- Humor (204)

- Innovative (183)

- Interactive (545)

- Internet/tech (97)

- Maps (578)

- News Media (34)

- Politics (329)

- Reference (97)

- Science (331)

- Source: Economist (101)

- Source: FT (92)

- Source: NYT (147)

- Source: Ritholtz (76)

- Source: USA Today (27)

- Source: Washington Post (90)

- Source: WSJ (135)

- Sports (58)

- Stock Market (74)

- Uncategorized (2)

- Updated regularly (76)

- US Economy (553)

- Video (22)

- Aram Korevaar: This chart is now being used as a projection in which countries such as China see themselves as in a [...]

- David: Welcome back Chart Porn! [...]

- J S: Thanks for the great story. Miss reading this blog. Hope to see you more active again. [...]

- jake: I lived in a DC row house for 6 years, and I'm writing this comment from my tiny 1 bedroom apartment [...]

- ronny pettersen: Hilarious and unfortunately accurate... ;-) [...]

Buybacks and Dividends

In: Bailout Commentary Stock Market US Economy

10 Dec 2008Floyd Norris — NYT

December 10, 2008, 11:31 am

Shareholder Value

Three numbers, courtesy of Howard Silverblatt of Standard & Poor’s, shed some light on what companies did with their cash during boom times:

Over the last four years, since the buyback boom began, from the fourth quarter of 2004 through the third quarter of 2008, companies in the S.&P. 500 showed:

Reported earnings: $2.42 trillion

Stock buybacks: $1.73 trillion

Dividends: $0.91 trillion

As a group, every dime they made, and more, went to shareholders. Roughly $2 went to shareholders who sold out for every $1 that was paid in dividends to shareholders who held on to their shares.

article and discussion: http://norris.blogs.nytimes.com/2008/12/10/shareholder-value/